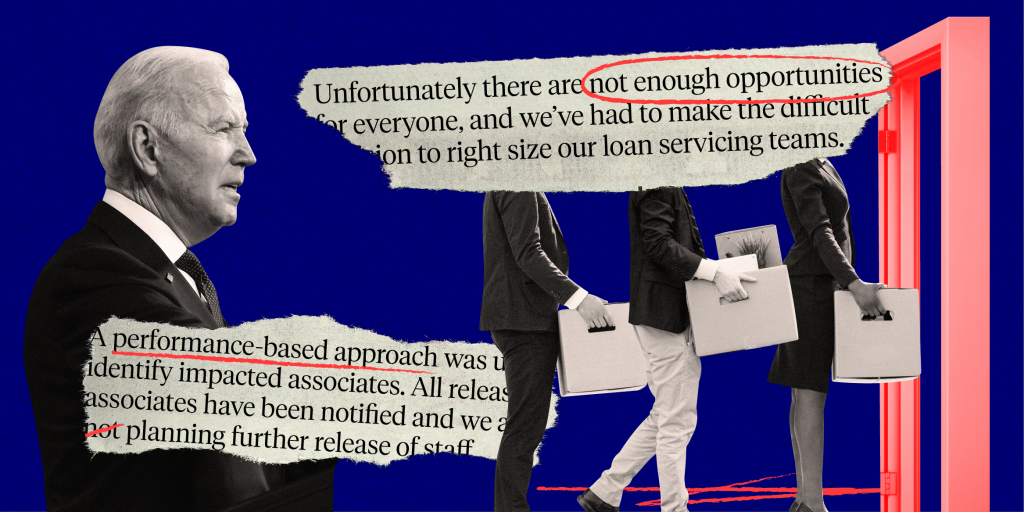

- An employee of student-loan servicer Nelnet leaked an email to Insider about layoffs at the company.

- Following the layoffs, Insider spoke to current and former Nelnet employees on company culture.

- With at least some student-loan forgiveness on the horizon, they say job security is lacking.

A major student-loan company that let go of about 150 workers last month said it's not planning to lay off any more of its employees.

But two people Insider spoke to, one a current and one a former Nelnet employee, are worried — especially as President Joe Biden is reportedly poised to forgive some portion of student debt over the coming months, a move that would greatly impact their industry.

Jo — a current Nelnet employee using a pseudonym for privacy — told Insider the lack of notice with the past layoffs has some employees in a "mass panic."

"We just didn't know who was going to be next, and they weren't saying anything to us," Jo said. "These people were being fired and removed without a word."

Nelnet did not comment to Insider on the process it took for notifying workers of layoffs, but when Insider reported last month that Nelnet laid off about 150 employees, the company said it was due to lack of work caused by the over two year pause on student-loan payments, and although they were able to "redeploy" some workers to different divisions.

"Unfortunately there are not enough opportunities for everyone, and we've had to make the difficult decision to right size our loan servicing teams," Nelnet spokesperson Ben Kiser told Insider.

Anne, an employee who was laid off from Firstmark Services, a private loan division of Nelnet, on May 24 and is also using a pseudonym for privacy, told Insider she can attest to the shock factor when she was notified she no longer had a job. When she started hearing rumors circulating that layoffs were coming, Anne said she brought the issue up with her manager and was assured she would be fine. But after a quick meeting and an email wishing her luck in her future endeavors, she was out of a job.

"It was spread around that roughly 40 people between federal and private were laid off due to there not being enough work," Anne said, referring to the two kinds of loans Nelnet services — those made by the US government and those made by private lenders. "But when the announcement was made about how many people actually got laid off, which was 150 instead of 40, that raised a red flag."

Not only were the layoffs much more than Anne expected — she also worked on private student loans, and it was confusing to her that she would be impacted by President Joe Biden's pandemic pause on federal student-loan payments, along with the potential loan forgiveness for only federal borrowers.

Nelnet did not comment on the layoffs from Firstmark Services. Kiser told Insider that "any decision affecting people's employment is difficult," and did not provide any additional information regarding potential future layoffs.

"Some people here are living paycheck to paycheck," Anne said. "We're worried about what is going to happen to the families if Nelnet starts laying off more people after having assured everyone they're not going to. It's going to hurt so many families."

'Nobody feels like they have job security anymore'

According to screenshots another current Nelnet employee provided to Insider, the way in which Nelnet went about the most recent round of layoffs sparked alarm among some employees.

One employee wrote in a group chat:

"welp y'all I'm logging out they just told me they're laying off people starting today bc of overage in workers" to which another employee responded: "ARE YOU FREAKING SERIOUS?"

The employee informed of the layoff later wrote in that chat: "It's all good. They said they're going to pay me for an extra 2 weeks as well as any leftover eto (earned time off) and the rest of today but I have to clock out now. It's just so crazy they didn't give a heads up. Just scheduled meeting this morning."

Anne said she got two weeks severance following her layoff, and according to her layoff package reviewed by Insider, any unused time off will be included in her final paycheck and the Employee Assistance Program, which provides a certain number of free counseling sessions, is available up to three years after termination.

But the student-loan business is anything but certain, and Nelnet employees aren't ready to take the company at its word, especially given the uncertainty surrounding student-loan relief. Biden is reportedly considering $10,000 in forgiveness for federal borrowers making under $150,000, and while the decision is likely to be announced in July or August, the White House has yet to confirm any details.

"Nobody feels like they have job security anymore. Working is very tense," Jo said. "It's very much full of people just pretending like it's business as usual, but it's clearly not."